Two of Investinor’s companies listed on Euronext Growth Oslo this Friday

Cyviz and Skitude will be listed on Euronext Growth Oslo (formerly Merkur Market) on Friday 18 December. Investinor has been the shareholder in both companies since 2014 and 2016, respectively, and had a great contribution to the processes of listing the companies.

- This is a big day for Investinor. Our task is to increase the supply of capital to growth companies. With respect to the listings, these two companies have together been provided with more than NOK 250 million of new growth capital. The investments in Cyviz and Skitude are very good examples of cooperation between entrepreneurs, government and private capital. When the companies are listed, it is also a sign that the companies have reached many of the goals we set at the time of the investment, says CEO of Investinor, Terje Eidesmo.

The listings of Cyviz and Skitude take place in addition to the listings of the Investinor’s companies Play Magnus and Exact Therapeutics earlier this year, also at Euronext Growth Oslo.

The portfolio companies poLight and BergenBio are already listed on the stock exchange, while Investinor has recently exited biopharmaceutical company Calliditas Therapeutics (which is listed in Stockholm and New York), with a gain of more than NOK 475 million.

Cyviz, which will be listed on Friday 18 December, designs, develops and delivers software and hardware solutions for full-scale conference rooms, control centers and experience centers. More than 30 of the companies from the Fortune 500 list are among their customers, including Accenture, Standard Chartered Bank and Chevron, in addition to the US Department of Defense. Investinor has an ownership stake in Cyviz of approx. 42 percent when the company is now listed. A short introductory video to Cyviz can be seen here.

- In recent years, Cyviz has worked hard to lay a good foundation for further growth and scaling. The listing, together with the new capital raised, strengthens the opportunity to accelerate growth. As an active owner, we will contribute in the company’s further development. We also create the conditions for new stock exchange investors to participate on the ownership side through the listing, says board member of Cyviz and investment director at Investinor, Thomas S. Wrede-Holm.

Investinor is, in addition to Wrede-Holm, also represented on the board of Cyviz by Investment Director Patrick Kartevoll.

- Increased digitalization is a clear trend that enables interaction with ever-increasing scope and complexity. On top of this, the corona situation has escalated the need for good solutions for digital interaction. When more people return to the office, hybrid meetings will be very widespread, where some are in the home office and others are gathered in larger rooms. Here, Cyviz has the best solutions and a strong organization to deliver to some of the most demanding customers globally, says Kartevoll.

Skitude is the second company to be listed on Friday 18 December. The company offers lift pass technology and community solutions to over 300 resorts with 1.8 million registered users and is a result of the merger between the lift pass system Skioo and Skitude in 2019. Investinor has been a shareholder since 2016 together with, among others, Aksel Lund Svindal and Canica. Investinor has an ownership stake in Skitude of approx. 16 percent when the company is now listed.

- The world’s alpine destinations are under-digitalized, and Skitude has the leading position both having the largest customer base of skiers and being the leading player in digital lift card systems. We are looking at a number of companies and initiatives to bring the alpine world together under one digital platform, says Bent Grøver, Chairman of the Board of Skitude and Investment Manager at Investinor.

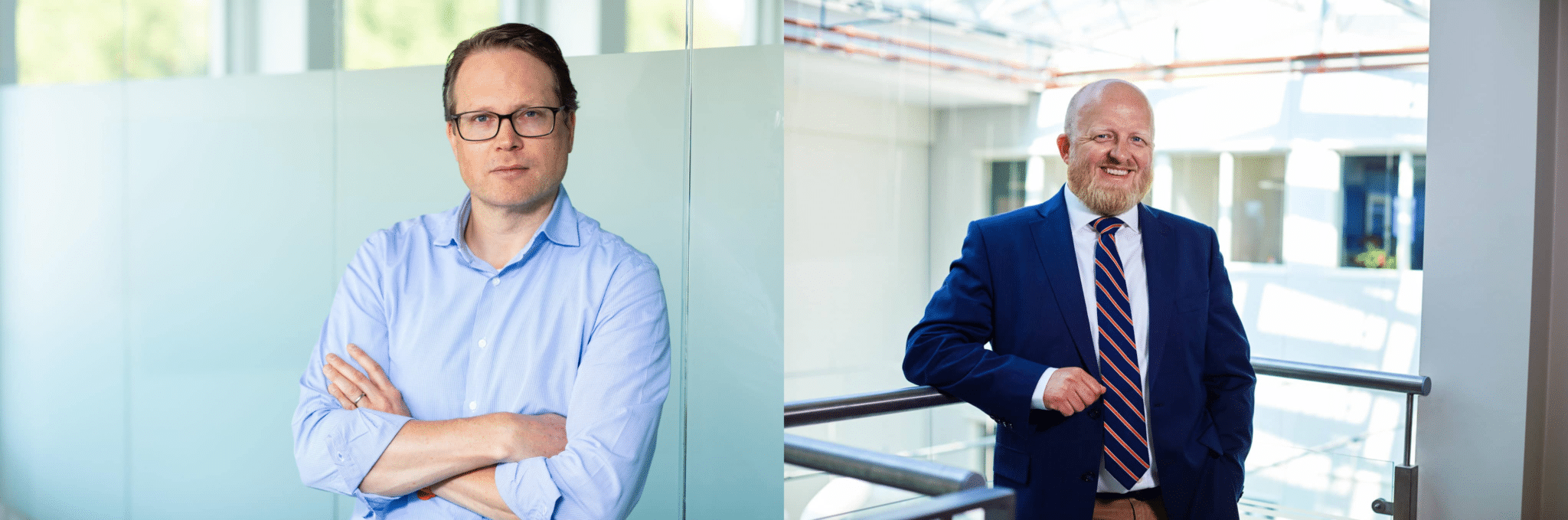

CEO in Investinor, Terje Eidesmo.

From the left: Thomas Wrede-Holm and Bent Grøver